North African countries are entering a transformative year for connectivity, with 2025 marking the rapid acceleration of 5G deployments. Tunisia became the first in the region to commercially launch 5G in February 2025, followed by Egypt in June. Algeria and Morocco are now preparing to join before year-end, positioning the region for widespread digital transformation.

Tunisia’s launch was notable for its spectrum strategy, combining 700 MHz and 3.5 GHz bands to deliver peak speeds above 300 Mbps at launch. All three operators—Tunisie Télécom, Orange Tunisie, and Ooredoo Tunisie—offered both mobile broadband and fixed wireless access (FWA) plans. While speeds rivaled fiber and VDSL, pricing parity and high CPE costs limited mass adoption of FWA. Still, the country quickly surged in the Speedtest Global Index, briefly leading North Africa.

Egypt, the region’s largest mobile market, followed in June with spectrum allocated in the 2500 MHz band. Telecom Egypt, Orange, Vodafone, and e& rolled out services initially in Cairo, Alexandria, and other high-traffic areas. Median mobile speeds doubled to more than 80 Mbps across the country, surpassing 100 Mbps on 5G networks. Operators boosted adoption with promotions and extra data allowances, though high CPE costs kept FWA less competitive compared to VDSL.

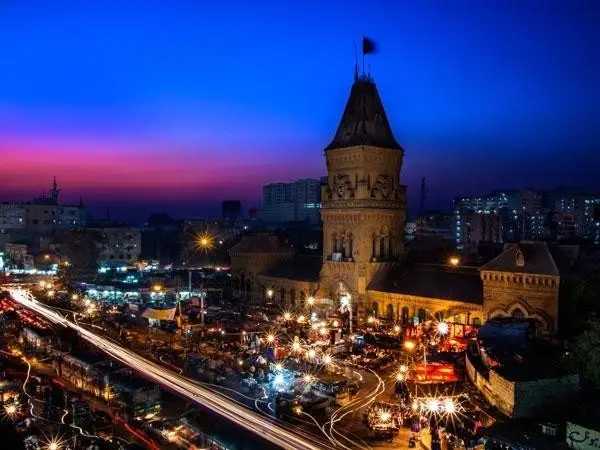

Algeria awarded its 5G licenses in July 2025 and is set to launch commercially in Q3. The first phase will cover eight provinces, including Algiers, Oran, and Constantine, with consumer adoption expected to grow quickly thanks to the high percentage of 5G-capable devices already in use. Meanwhile, Morocco’s regulator ANRT finalized its tender in July, granting licenses to Maroc Telecom, Orange, and inwi. The rollout is closely tied to major sporting events—first covering AFCON stadiums and host cities in late 2025, and then expanding coverage to 45% of the population by 2026 and 85% by 2030 as part of the Digital Morocco 2030 program.

The socio-economic potential of 5G in North Africa is vast. Faster, more reliable connectivity promises to enhance daily life—video streaming, calls, and navigation—while driving economic growth by enabling innovation in sectors like logistics, agriculture, and smart cities. For governments and operators, the challenge lies in balancing ambitious coverage targets with affordability. Lower device costs, flexible packages, and infrastructure partnerships will be key to ensuring 5G adoption translates into real digital and economic gains.

With Tunisia and Egypt already demonstrating strong performance gains, and Algeria and Morocco preparing to switch on 5G networks, North Africa is entering a new phase of competition and innovation. If combined with favorable policies and investment, 5G could establish the region as a competitive digital hub in the MENA landscape.

Tunisia and Egypt’s early launches signal a decisive shift in regional telecoms, setting benchmarks in speed, coverage, and adoption. As the rest of North Africa follows, 2025 is shaping up to be the year when the region truly embraces the next generation of connectivity.