PayTabs Egypt, a prominent provider of digital payment solutions, has announced a partnership with Souhoola, a leading Egyptian buy now, pay later (BNPL) platform. This collaboration, revealed in a recent press release, will introduce an additional BNPL service to PayTabs Egypt’s diverse payment options.

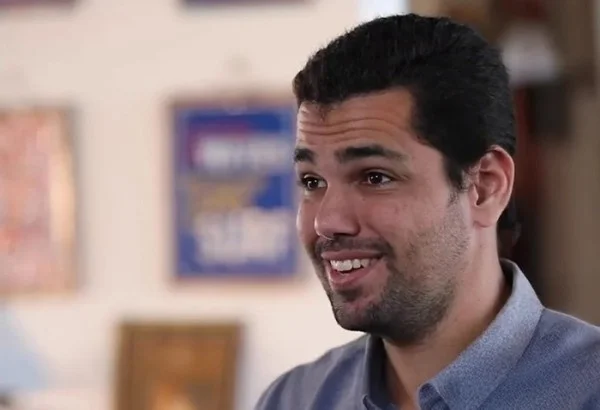

Karim Eyada, General Manager of PayTabs Egypt, expressed that integrating Souhoola’s BNPL solution not only caters to the evolving purchasing behaviors and lifestyles of consumers but also gives their merchants a competitive advantage. This initiative will allow PayTabs Egypt’s eCommerce clients to broaden their online payment methods, responding to the increasing consumer demand for convenience and enhancing the likelihood of purchases.

Ahmed Al-Shanawany, CEO of Souhoola, emphasized their commitment to providing flexible and accessible payment options that benefit both consumers and merchants. “We are excited to work alongside PayTabs Egypt to deliver a smooth and enjoyable shopping experience,” he remarked.

Previously, in August 2022, PayTabs Egypt had entered a partnership with Waffarha, a digital shopping platform, to support digital payments and advance Egypt’s transition towards a cashless society. This partnership facilitates credit card payments and the secure storage of card details for future transactions, thereby attracting more customers through simplified payment options.

Additionally, other significant collaborations include Visa’s February agreement with the Egyptian Banks Company to introduce new electronic payment solutions, digital wallets, and enhance the process for receiving international remittances by Egyptian expatriates.

In another move towards financial literacy and inclusion, Mastercard and Ingiz, a family financial management startup, joined forces in August to launch a digital payments application aimed at educating Egypt’s youth on financial management, expanding the app’s accessibility to a broader consumer and merchant base.