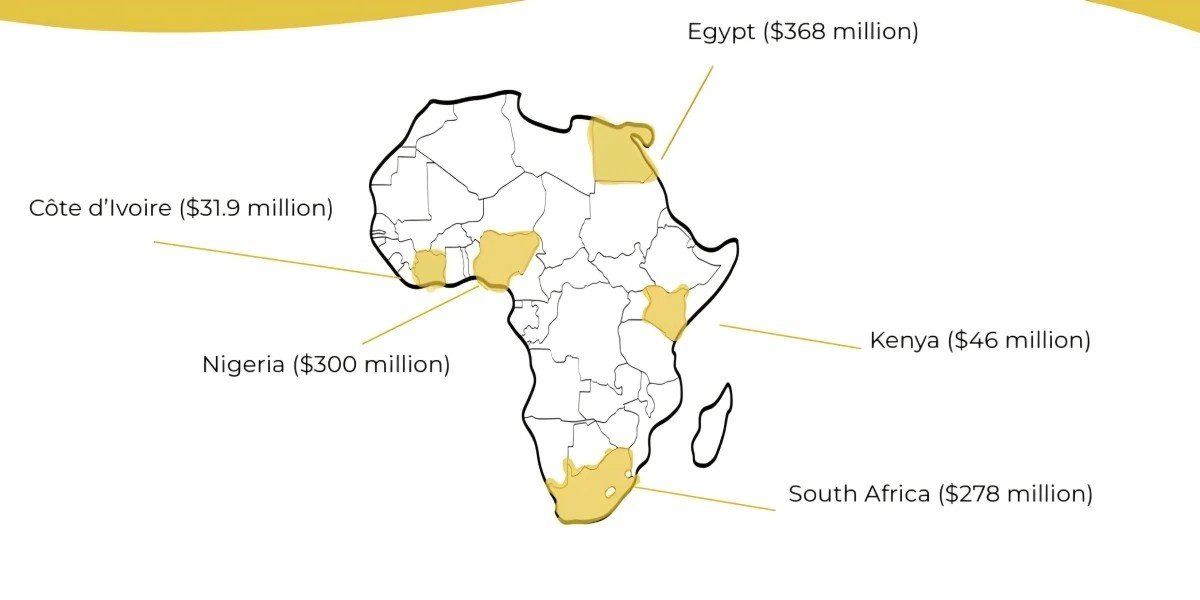

Telecom Egypt has successfully secured an EGP 18 billion syndicated loan, a strategic move to enhance its cash management and financial robustness. The loan, which involves a consortium of 13 banks, is spearheaded by the Commercial International Bank – Egypt (CIB) and Banque Misr, serving as the Initial Mandated Lead Arrangers and Bookrunners. The National Bank of Egypt also plays a key role as a Mandated Lead Arranger and Bookrunner.

This seven-year facility is aimed at refinancing Telecom Egypt’s existing short-term EGP debts. The refinancing is timed strategically to bolster the company’s liquidity, improve cash flow, and provide increased financial flexibility essential for supporting its long-term expansion strategies. The move also reflects Telecom Egypt’s commitment to maintaining sound financial management and its capacity to adapt to evolving market challenges while minimizing risks and driving sustainable growth.

Mohamed Nasr, the Managing Director and CEO of Telecom Egypt, emphasized the importance of this financial restructuring. “Transforming our short-term EGP liabilities into this more favorable long-term facility marks a critical enhancement of our financial structure. This not only augments our financial leeway but also aligns our debts more closely with our revenue streams. With the backing of this robust banking consortium, we are well-positioned to leverage upcoming opportunities and continue delivering shareholder value,” he stated.

Mohamed El-Etreby, CEO of the National Bank of Egypt, highlighted the significant role of the banking sector in facilitating such critical financial arrangements. “Our commitment to supporting substantial infrastructure ventures, especially in the ICT sector, is unwavering. This sector is fundamental to fostering a sustainable digital economy, enhancing financial inclusion, and solidifying Egypt’s stature as a global and regional ICT hub,” he commented. El-Etreby also noted, “This collaboration with Telecom Egypt not only showcases our ability to provide tailored financial solutions but also boosts the company’s capacity to manage operational costs effectively, thus contributing directly to Egypt’s Sustainable Development Goals and Vision 2030.”