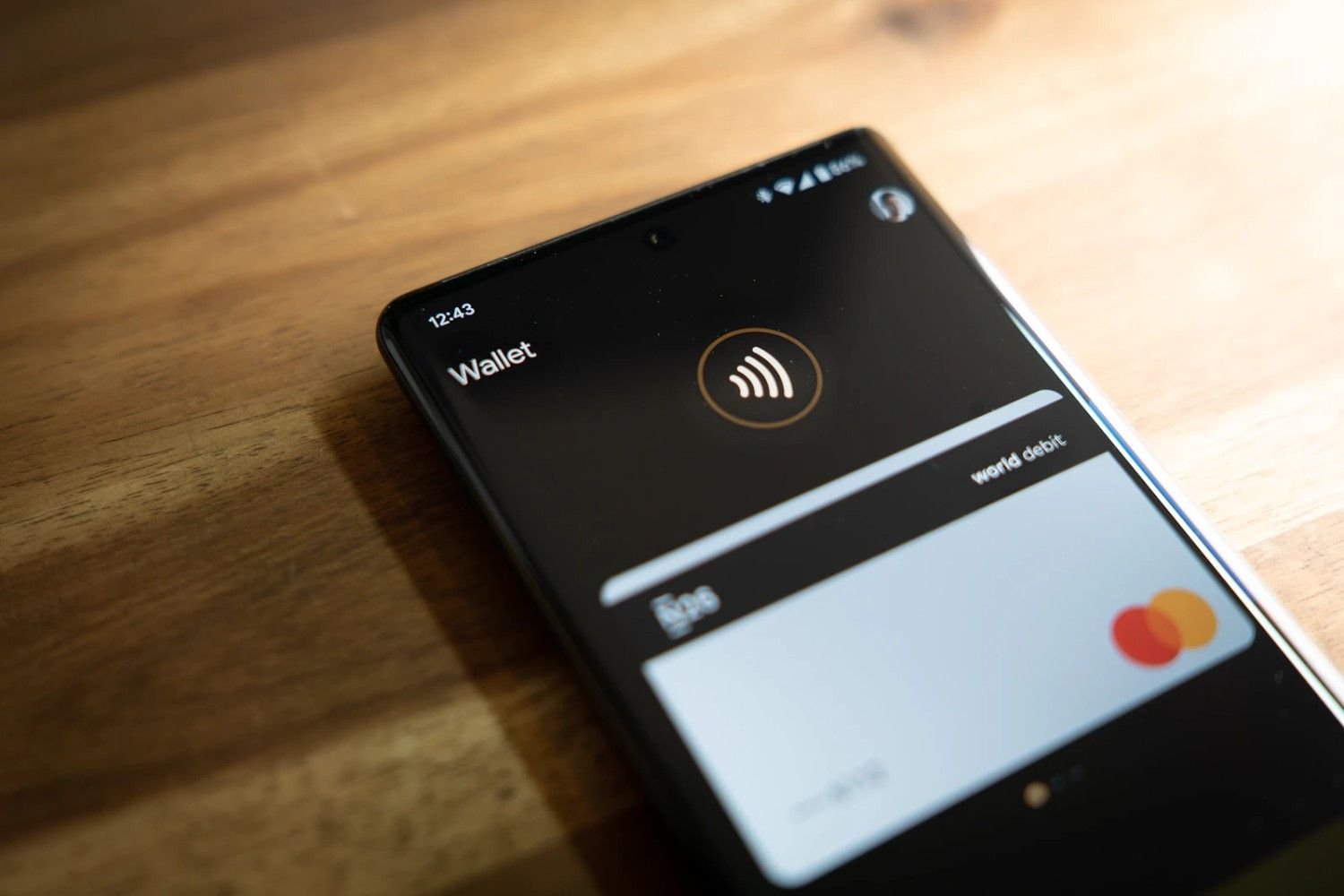

e& Egypt, a leading mobile operator in Egypt, has introduced the country’s first international mobile transfer service, allowing users to send and receive money instantly through its e& Cash wallet app. The new service eliminates the need for physical branches or third-party agents, offering seamless cross-border transactions.

Currently, the service supports transfers between Egypt, the UAE, and Saudi Arabia, with plans for expansion to additional countries. Leveraging its regional infrastructure, e& Egypt aims to streamline cross-border remittances and enhance access to financial services, particularly for users who previously faced delays. For example, someone overseas can send funds to a recipient in Egypt, who can instantly access the money on their phone—without the hassle of waiting in queues or dealing with agents.

This launch reflects a broader shift in Egypt’s financial technology landscape, as the country has increasingly adopted digital tools in its ongoing economic transformation. According to the Central Bank of Egypt, account ownership has surged by over 200% between 2016 and 2024, with more than 52 million Egyptians holding transactional accounts, including mobile wallets, prepaid cards, and bank accounts. This shift marks a move away from traditional banking systems and towards greater financial inclusion, especially in underserved areas.

Egypt is also emerging as one of North Africa’s leading fintech hubs, with more than 177 fintech startups and payment service providers (PSPs) reported in 2022. The country’s digital payments market is expected to reach a transaction value of $31.31 billion by 2025, according to Statista.

This trend is not limited to Egypt; other African countries like South Sudan and Somalia are also launching their national instant payment systems, reflecting a continent-wide embrace of real-time, digital-first financial solutions.

For Egyptians, this new instant transfer service represents a step forward in closing the gap between financial access and inclusion. Whether used for business transactions, family support, or personal convenience, the service makes transferring money more efficient, secure, and accessible.