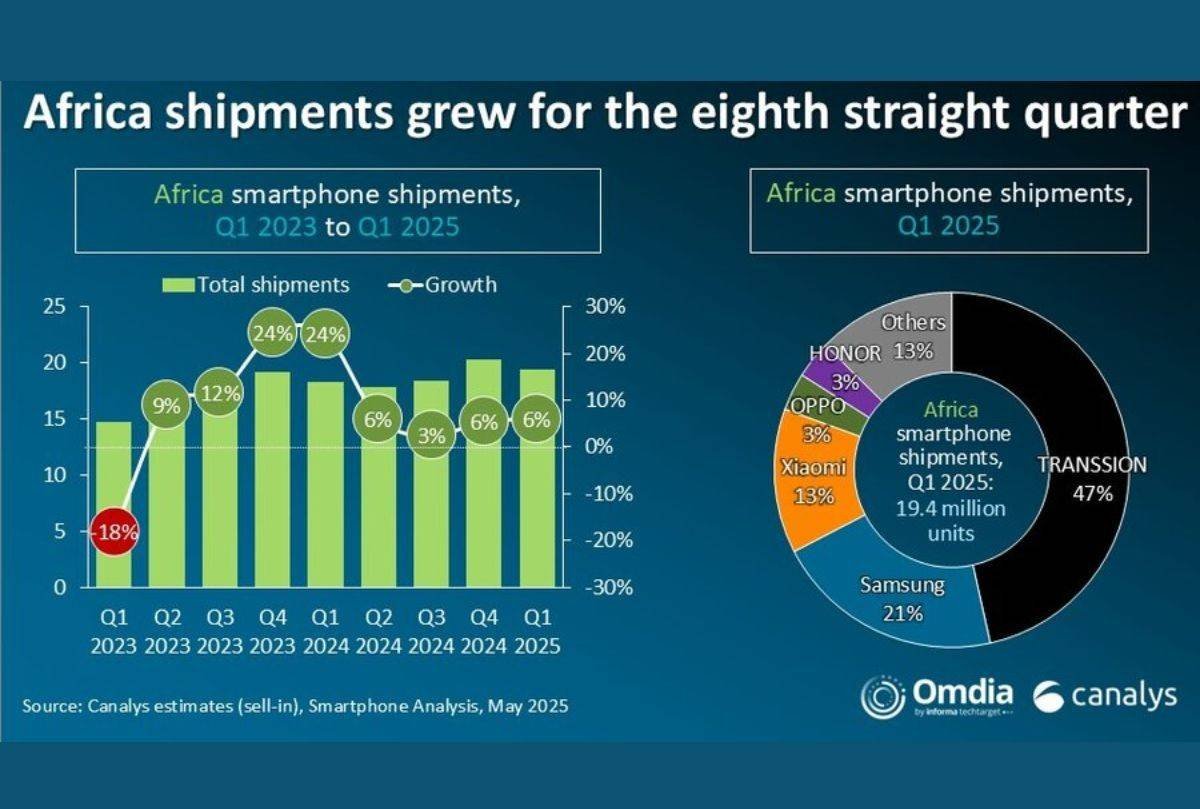

Africa’s smartphone market recorded its eighth consecutive quarter of growth, with shipments rising 6% year-on-year to 19.4 million units in Q1 2025, according to Canalys (now part of Omdia). This growth defies global trends amid economic headwinds, driven by resilient offline retail, vendor market coverage, and policy support.

North Africa led by Egypt’s 34% shipment growth, fueled by regulatory measures such as IMEI whitelisting and enhanced local manufacturing. Algeria’s market expanded 16%, boosted by government policies and digital payment adoption. In Sub-Saharan Africa, South Africa grew 14% thanks to excise tax cuts and network upgrades, while Nigeria’s market contracted 7% due to economic pressures. Kenya showed a modest 1% growth, supported by flexible financing.

After seven quarters of growth, TRANSSION faced a 5% decline as competitors matched its successful distribution model. Samsung maintained strong performance with 21% market share, popularizing its A-series budget devices. Xiaomi surged 32%, led by Egypt and Nigeria, with Redmi and A-series models driving sales. OPPO and HONOR also recorded notable growth, the latter boosted by premium 5G bundles and strategic partnerships.

Despite promising demand for 4G devices (85% of shipments) and mid-tier phones (42% share), economic challenges like rising living costs, debt sustainability concerns, and infrastructure gaps limit market expansion. Financing partnerships aid access but raise caution over consumer debt. Canalys forecasts a modest 3% overall growth for Africa’s smartphone market in 2025, amidst volatility driven by macroeconomic and trade tensions.