The International Gateway Operators Forum (IOF) has strongly criticised Bangladesh’s proposed new telecom network and licensing framework, warning it threatens local telecom entrepreneurs by disproportionately benefiting foreign companies. Currently, foreign firms control 75% of Bangladesh’s telecom business, and IOF leaders fear the new structure could lead to the collapse of nearly 100 local firms involved in international voice and data gateway services, interconnection exchanges, and related sectors.

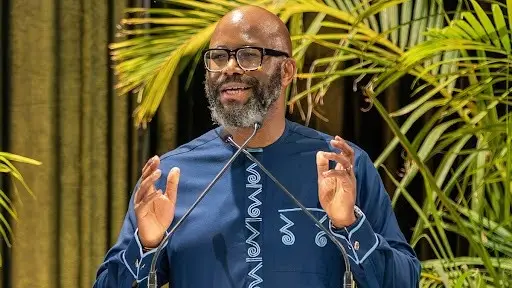

At a press briefing in Dhaka, IOF President Asif Rabbani urged the regulator to protect Tk5,000 crore in local investments by maintaining the right of local operators to route all incoming international machine-generated SMS (A2P), as outlined in the existing International Long Distance Telecommunication Services (ILDTS) Policy of 2010. He highlighted that over 3 crore international A2P messages enter Bangladesh monthly without local regulatory tariffs, resulting in minimal government revenue—around $160,000 per month—while mobile operators continue the business through non-transparent arrangements.

Rabbani claimed that if routing were restored to IGW operators per the ILDTS policy, government revenue could increase eightfold to $1.25 million monthly, providing a lifeline for the IGW sector amid evolving market challenges. Since 2008, IGW operators have contributed over Tk10,000 crore to government revenues. The sector began with 3 licenses in 2008 and expanded to 29 by 2012 due to the lucrative nature of the business.

However, the rise of app-based internet calling has slashed international incoming cellular calls by more than 85% to 12 million minutes daily. IOF COO Mushfique Manzoor said the regulator has ignored its own policy that mandates international A2P SMS routing by IGW operators, depriving the industry of promised business.

The ILDTS policy, while praised for enhancing government oversight, has also been criticised for adding layers that increase consumer costs due to multiple profit-taking and revenue-sharing levels. Meanwhile, six IGW operators linked to Awami League politicians have shut down owing over Tk1,400 crore in unpaid dues.

A 2015 BTRC arrangement created two layers within the IGW sector and formed a consortium to manage call routing and revenue sharing. Recently, the regulator dismantled this additional switch, necessitating further investments amid a Tk200 crore upgrade by the industry.

BTRC’s new simplified licensing topology divides the telecom sector into three broad categories—international connectivity services, national infrastructure connectivity services, and access network services. Existing voice, data gateway, and interconnection exchange licenses will not be renewed; firms will migrate to broader category licenses.

Manzoor warned that this new structure risks cementing foreign oligopoly in Bangladesh’s telecom market. IOF demands strong opposition to any concentration of interests across multiple licensing layers and calls for safeguarding local investments.

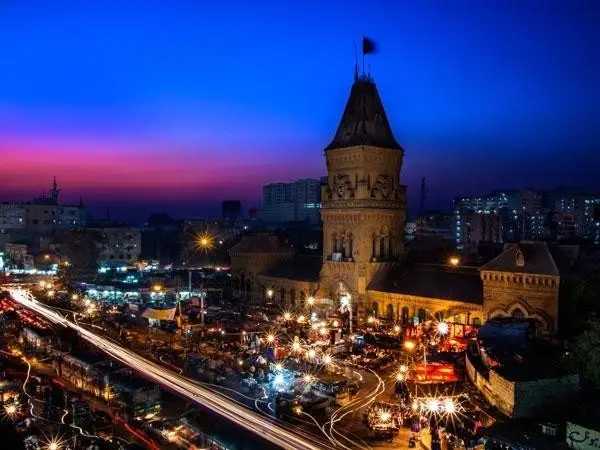

The press briefing followed a workshop titled “International Gateway: Challenges and Potentials,” jointly organised by IOF and the Telecom and Technology Reporters Network Bangladesh.