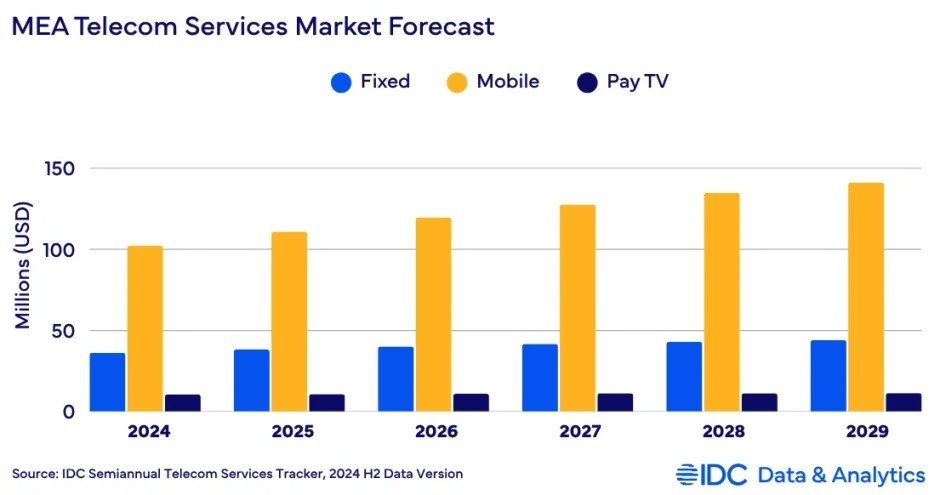

Spending on communications services across the Middle East and Africa (MEA) reached $149 billion in 2024, reflecting a robust 7.7% growth—significantly outpacing the global average of 2.2%, according to IDC data. This upward momentum is projected to continue in 2025, with telecom and pay TV services expected to grow 7.3% to reach $159.9 billion.

MEA led the global post-COVID telecom recovery in 2024, fueled largely by infrastructure investments aimed at expanding network coverage, particularly in underserved African markets. Demand for mobile data remains strong despite tariff hikes implemented to mitigate inflationary pressures in countries like Türkiye, Egypt, Nigeria, Sudan, and Zimbabwe.

Consumer preferences continue shifting from fixed voice to mobile voice and data services. Over-the-top (OTT) platforms play a vital role in markets where mobile devices serve as the primary internet gateway. While this trend supports mobile revenue growth, it intensifies challenges for legacy fixed-line services, noted IDC analyst Ivana Slaharova.

IDC’s latest forecast is slightly more conservative than previous estimates, accounting for moderated inflation and updated operator projections.

Telecom operators in MEA are increasingly rebranding as technology companies (“techcos”) to diversify through digital transformation initiatives including AI adoption, cloud-native platforms, edge computing, and accelerated 5G and fiber deployments. While 5G coverage is established in Gulf countries, broader regional adoption is anticipated over the next five years, alongside growth in fiber and low Earth orbit (LEO) satellite services.

Key Operator Investments

- e& (formerly Etisalat): Leading Gulf region with capital investments in 5G infrastructure, digital services, and international expansion, including technology and media sectors.

- stc Group (Saudi Arabia): Investing heavily in network modernization, 5G rollout, and data centers, aligned with Saudi Vision 2030.

- Ooredoo: Prioritizing digital innovation, cloud, and mobile upgrades in Qatar, Oman, and Algeria.

- Zain Group: Expanding 5G in Kuwait and Saudi Arabia, focusing on fintech and data monetization.

- MTN Group (Africa): Investing in rural connectivity, 5G pilots, and fintech, especially in South Africa and Nigeria.

- Vodacom: Growing fiber and mobile broadband, supported by Safaricom partnership and Vodafone Egypt acquisition.

- Orange: Enhancing presence in North and West Africa with mobile/fixed network investments and expanding digital banking and enterprise services.

These operators are increasingly collaborating with global tech firms and cloud providers to enhance service offerings and meet growing digital and enterprise connectivity demands.

Risks and Challenges

Geopolitical tensions, trade disputes, and U.S.-imposed telecom equipment tariffs present risks that could increase costs and delay infrastructure projects, including 5G and AI deployments. These challenges may dampen broader economic growth and consumer spending, though the direct impact on telecom service revenues remains limited for now.