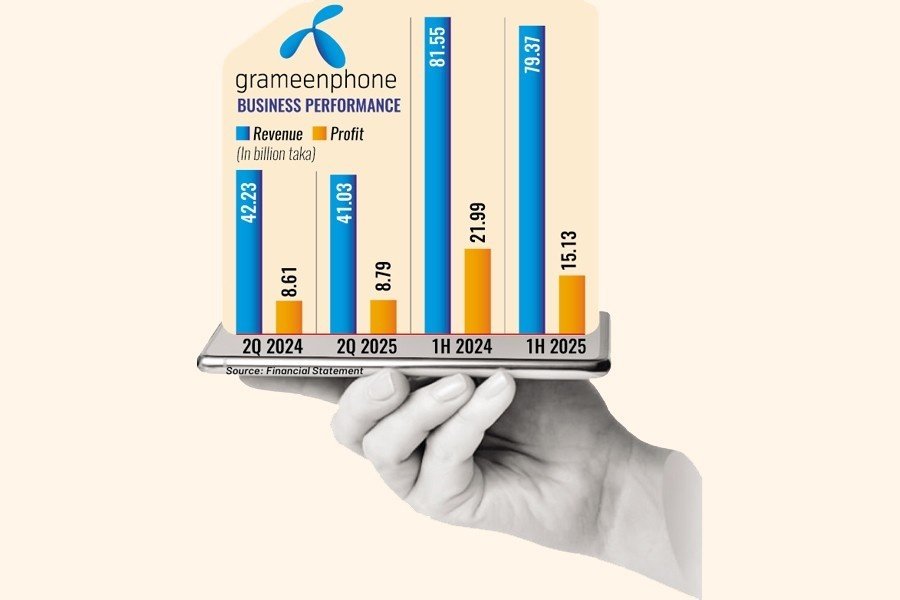

Grameenphone, Bangladesh’s leading telecom operator, posted a slight year-on-year profit increase of 2.07 percent, reaching Tk 8.79 billion in the second quarter (Q2) of 2025, despite a decline in revenue. The company attributed the marginal profit growth primarily to a reduction in income tax expenses.

Alongside releasing its Q2 and half-year (H1) financial statements, Grameenphone announced a 110 percent interim cash dividend for the period ending June 2025. However, the announcement did little to boost its stock performance, with shares rising modestly by 1.15 percent to Tk 300.2 on the Dhaka Stock Exchange during Thursday’s trading session.

Market analysts noted that the company’s year-on-year revenue and profit declines over the first half of the year weighed on investor enthusiasm. Net profit for H1 2025 dropped 31 percent to Tk 15.13 billion, driven by a 12 percent fall in operating profit compared to the same period last year. The operating profit slump was linked to increased costs related to operations, maintenance, depreciation, and amortization.

In Q2 alone, revenue declined 2.8 percent year-on-year to Tk 41 billion, largely due to decreased income from mobile communication services. Earnings from customer equipment also fell sharply in the quarter compared to Q2 2024. The company cited a weakened macroeconomic environment during the quarter as a key factor behind the revenue downturn.

Operating expenses remained largely unchanged year-on-year in Q2, while other income—mainly from finance and foreign exchange gains—slightly decreased. Profit before tax in Q2 dropped 6 percent to Tk 14.04 billion. The tax burden eased, however, with current and deferred tax payments falling 23 percent and 17 percent respectively compared to the prior year’s quarter, helping the company eke out a small profit gain.

Grameenphone’s declared interim cash dividend of 110 percent corresponds to distributing 98 percent of after-tax profits for H1 2025. Shareholders will receive Tk 11 per share of Tk 10 face value, amounting to a total dividend payout of Tk 14.9 billion. Historically, the company has maintained strong dividend payouts, ranging from 99 to 123 percent between 2020 and 2024, except for 2023.

Subscriber growth showed slight improvement, with total subscribers rising to 86.3 million in Q2 2025 from 85.3 million in Q2 2024. Active data users also increased to 50.3 million from 49.7 million year-on-year.

As of June, sponsor-directors hold a dominant 90 percent stake in Grameenphone, while institutions, foreigners, and general investors own 6.5 percent, 0.97 percent, and 2.53 percent respectively. The stock price has been volatile in recent months, falling from Tk 346.40 in late February to Tk 273.30 by late May before recovering to Tk 300.20 by Thursday.