More than 80 percent of Nepali adults own mobile phones, but only 6 percent use mobile money accounts, according to the World Bank’s Global Findex 2025 report. Despite this, mobile money is driving a rise in formal savings, with 35 percent of adults in Nepal saving regularly. The report shows increasing access to financial accounts in low- and middle-income countries, fueled by mobile technology. In Nepal, 19 percent of adults made digital payments, 14 percent own a debit card, though only 5 percent actively use it. Gender disparities persist, with 17 percent of men owning debit or credit cards versus 11 percent of women.

Digital engagement includes 18 percent accessing accounts via mobile or internet, and 13 percent using digital platforms for transactions. However, barriers remain: 12 percent cited distance to financial institutions, and 17 percent cited high costs. The digitization of remittances is growing, with 86 percent of Nepali adults using financial accounts to send domestic remittances.

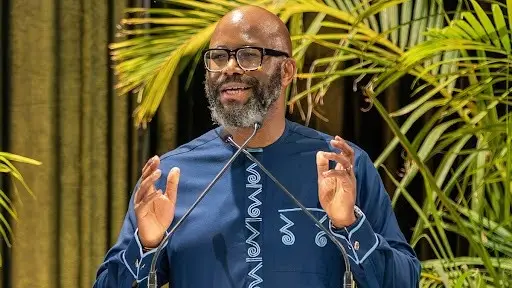

World Bank President Ajay Banga emphasized that financial inclusion strengthens national systems by increasing capital for investment and innovation. Globally, nearly 80 percent of adults now own an economic account, up from 50 percent in 2011, but 1.3 billion adults remain unbanked. Mobile phones present an untapped opportunity, with 900 million unbanked adults owning phones.

Progress in narrowing the gender gap is noted, with women’s account ownership in developing countries nearly doubling in a decade. Still, many unbanked adults cite household account sharing as a reason for not having their own account. The report also highlights growing mobile phone and internet ownership globally, driving digital transactions despite emerging security risks.

Digital payments are rising, with 42 percent of adults in developing countries using mobile or card payments in 2024, up from 35 percent in 2021. Receiving government payments digitally is becoming widespread, promoting transparency and reducing theft. Financial accounts empower women economically and socially, as seen in case studies from the Philippines, India, and Nepal where direct payments to women increased decision-making power and household spending on essentials.

The World Bank underscores that digital finance, coupled with inclusive policies, can unlock economic opportunities, particularly for women, fostering resilience and growth.