Robi Axiata posted a remarkable 134% year-on-year increase in profit, reaching Tk 2.57 billion for the second quarter ended June 2025, despite a challenging macroeconomic environment and intense market competition.

Consolidated earnings per share (EPS) jumped to Tk 0.49 from Tk 0.21 in the same period last year, according to unaudited financial statements released after Robi’s board meeting.

Although revenue declined 2% year-on-year to Tk 25.55 billion—indicating the operator has not yet fully recovered to pre-uprising performance levels—the company sustained strong profit growth. This was driven by a lower impact from the taka’s devaluation against foreign currencies and significant reductions in operating expenses.

“Cost efficiency continues to gain momentum with new home-grown digital solutions enabling Robi to maintain profit growth,” said M. Riyaaz Rasheed, acting CEO and CFO of Robi Axiata.

Key cost cuts included a drop in selling and distribution expenses to Tk 2.89 billion from Tk 4.21 billion, a 34% reduction in dealer commissions, and an 18% decrease in advertising expenses compared to the previous year’s quarter. Robi also gained Tk 19.63 million in forex transactions in Q2, reversing a loss of Tk 475 million in the same period last year.

Robi added 1 million new subscribers in Q2, bringing the total active subscriber base to 57.4 million. Of these, 76.8% are data users and 67% use 4G services. The operator maintained its leadership in 4G subscribers with 99.3% of its 18,366 sites supporting 4G by June-end.

EBITDA reached Tk 13.47 billion with a 52.7% profit margin, growing 10.1% year-on-year—highlighting strong operational efficiency. Robi invested Tk 2.3 billion in capital expenditure during the quarter to strengthen its network and digital business.

Mr. Rasheed cautioned against market power concentration undermining telecom reform benefits and urged regulatory action for fair industry growth.

Robi’s stock rose 2.61% to Tk 27.5 on the Dhaka Stock Exchange following the earnings announcement.

For the first half of 2025, profit increased 78% year-on-year to Tk 3.83 billion, while revenue dropped 4.4% to Tk 48.96 billion.

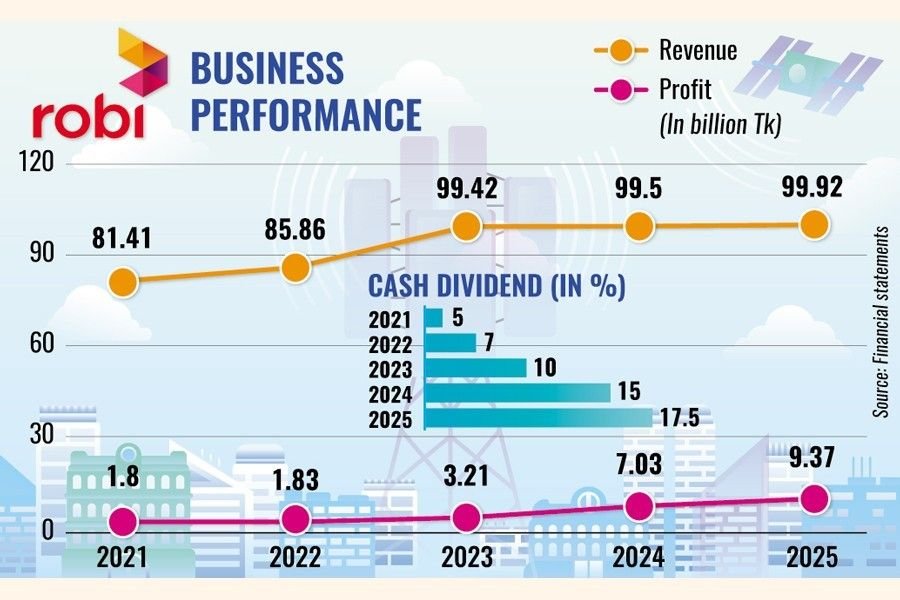

In 2024, Robi posted a record annual profit of Tk 7.03 billion—a 119% increase—while revenue grew 1% to Tk 99.5 billion despite disruptions from internet shutdowns and flash floods. The company paid its highest cash dividend since listing, at 15%.

Additionally, Axentec PLC, an affiliate of Robi Axiata, recently launched Axentec Cloud, Bangladesh’s first Tier-4 cloud platform fully hosted locally, marking a milestone in the country’s digital infrastructure.