Africa’s smartphone market is emerging as one of the fastest-growing globally, with shipments rising 7% year-on-year in Q2 2025 to 19.2 million units, according to Canalys (now part of Omdia). The growth outpaced most global markets, fueled by easing inflation, stronger currencies, and rising consumer demand across key economies.

Egypt led with 21% growth driven by local manufacturing and Eid-season demand, while Nigeria rebounded with 10% growth. South Africa saw 5G smartphone shipments soar 63%, thanks to affordable financing and operator partnerships. However, smaller markets such as Algeria (-27%) and Morocco (-7%) lagged due to import restrictions and weak demand.

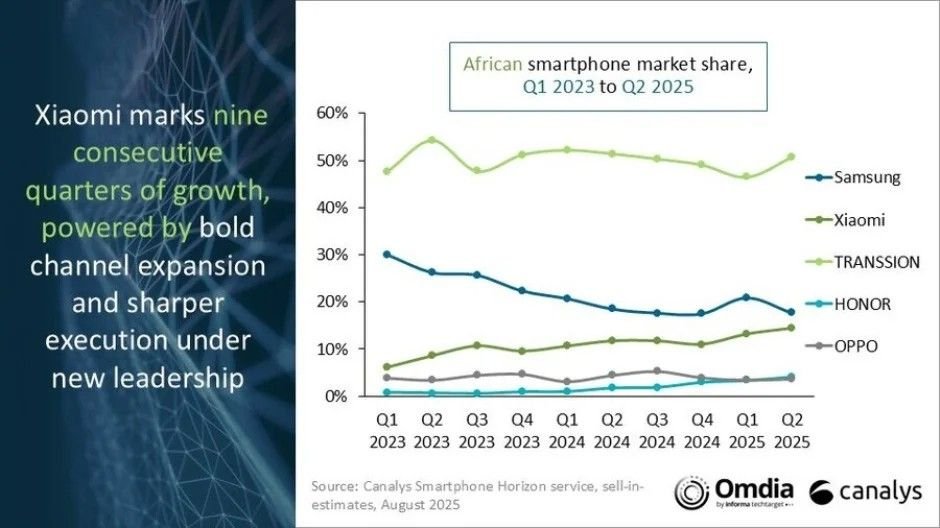

The surge was led by affordable smartphones under $100, which grew 38% year-on-year, making devices more accessible to rural and first-time buyers. TRANSSION (TECNO, itel, Infinix) maintained dominance with a 51% share, shipping 9.7 million units. Samsung held 18% despite slight growth, while Xiaomi surged to 14% share with 2.8 million units. HONOR recorded the strongest leap, doubling its share to 4% with 0.8 million units. OPPO remained flat at 4%, while smaller brands declined.

For buyers, this translates into more affordable phones, wider financing options, stronger local assembly of “Made in Africa” devices, and faster 5G adoption at lower price points. With smartphone penetration just crossing 50% of mobile connections, Africa is poised for another 3% growth in 2025, solidifying its status as a global hotspot for mobile innovation and affordability.