National Bank of Kuwait (NBK) has announced major updates to its Mobile Banking App, introducing new features and improvements designed to deliver a smarter, more seamless digital banking experience. The enhancements reflect NBK’s commitment to innovation and customer convenience, empowering users with greater control over their finances anytime, anywhere.

Fixed Saving Plan Account Opening

For the first time, customers can now open a Fixed Savings Account directly through the NBK Mobile Banking App—an option previously limited to branch visits. The account supports monthly installment savings for up to 15 years, with competitive fixed interest rates of up to 4%. Customers can select a savings plan ranging from 5 to 15 years, with deposits between KD 5,000 and KD 50,000. Interest is calculated daily and capitalized monthly, ensuring guaranteed long-term returns.

Simplified Standing Orders

The new update enables customers to set up standing orders with just a few taps, offering faster processing for transfers between NBK accounts or to other local banks. Customers also receive instant final approval, streamlining the process significantly.

Additional Enhancements

- WAMD Refunds: Refund periods for transferred funds have been extended from one day to seven days, with an option to specify refund reasons.

- Improved Access Recovery: Enhanced username and password recovery is now available via the Kuwait Mobile ID app, providing a faster, more convenient way to regain account access.

Customer-Centric Approach

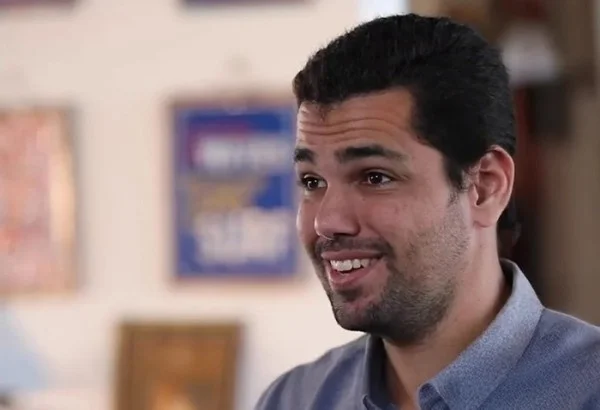

Mr. Mohammad Al-Dakhil, AVP – Head of Digital Banking Channels at NBK, emphasized that the updates align with NBK’s vision to continuously enhance digital services: “Our goal is to keep pace with our customers’ evolving needs, offering them an unmatched digital banking experience that empowers them to manage their finances with ease, convenience, and complete flexibility.”

The NBK Mobile Banking App already provides a comprehensive range of services, from opening accounts and issuing prepaid/credit cards to managing loyalty rewards, settling dues, and paying e-bills. With growing adoption and active engagement, the app has established itself as the preferred platform for everyday banking in Kuwait.