Makhazen — the newly rebranded Agility Public Warehousing Company — reported solid operating performance in Q3 2025 following the deconsolidation of Agility Global PLC. For the quarter ending September 30, the Kuwait-based infrastructure, logistics, and industrial services company posted KD 146.7 million in EBITDA, KD 38.7 million in revenue, and KD 137.7 million in net profit from continuing operations.

The results include a one-off accounting gain of KD 138.3 million linked to Agility Global’s reclassification as an associate after Makhazen’s stake fell to 25%. Assets and equity adjusted downward due to the restructuring. Excluding the one-off, adjusted Q3 net profit reached KD 12.7 million — up 207% year-on-year — and adjusted EBITDA climbed 46% to KD 21.7 million. Nine-month adjusted earnings also showed strong growth, with EBITDA up 19% and net profit up 82%.

Makhazen continues to execute a Kuwait-focused investment strategy, committing more than KD 100 million through 2030. In 2025, KD 22 million has been deployed into logistics infrastructure, recycling, customs digitization, and related initiatives. Key projects advancing include the South Village development, the MRC metal reclamation facility, and the expansion of GCS services.

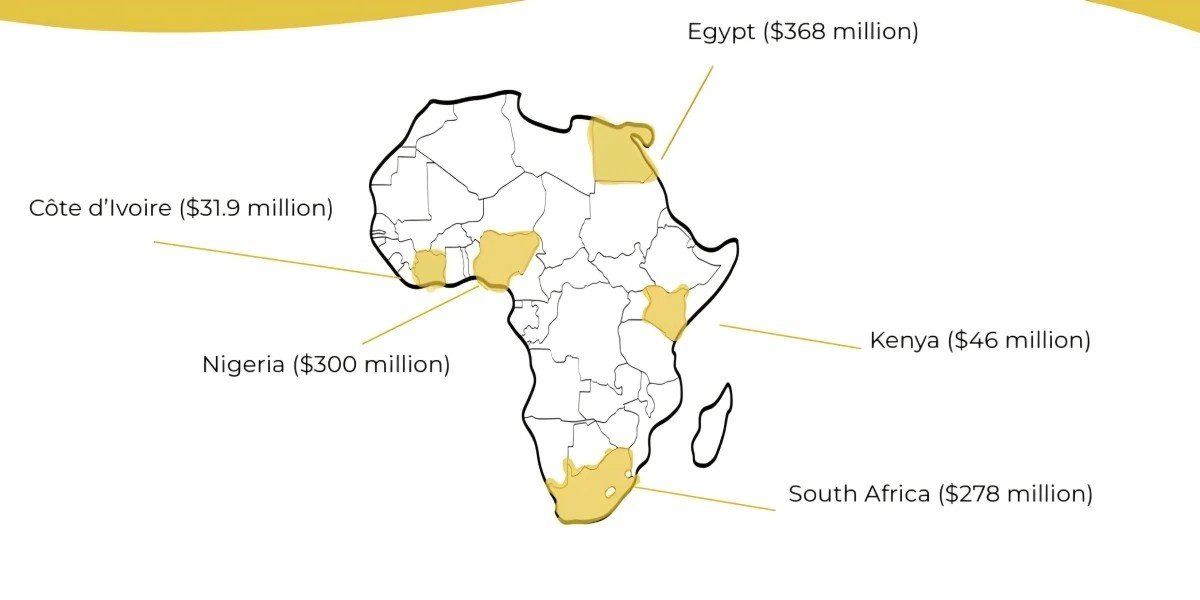

Agility Global — now treated as an equity-accounted associate — recorded $52 million in Q3 net earnings with higher EBIT, EBITDA, and revenue driven by Menzies and Agility Logistics Parks. Makhazen said its transformed business model strengthens alignment with Kuwait’s economic priorities and positions the company for long-term value creation.