The Middle East smartphone market sustained strong momentum in 2025, with Samsung reinforcing its leadership position across both premium and mid-range segments, according to a new report by Omdia.

Smartphone shipments in the Middle East, excluding Turkey, reached 54.8 million units in 2025, marking a 13 percent increase and the third consecutive year of double-digit growth. The market ended the year on a high note, with fourth-quarter shipments rising 20 percent year-on-year to 14.9 million units.

Growth was supported by a wave of flagship launches, expanded financing and trade-in programs, strong tourism-driven retail demand, and ongoing device upgrade cycles across Gulf markets. As the market matures, profitability and brand positioning are becoming increasingly critical alongside shipment volumes.

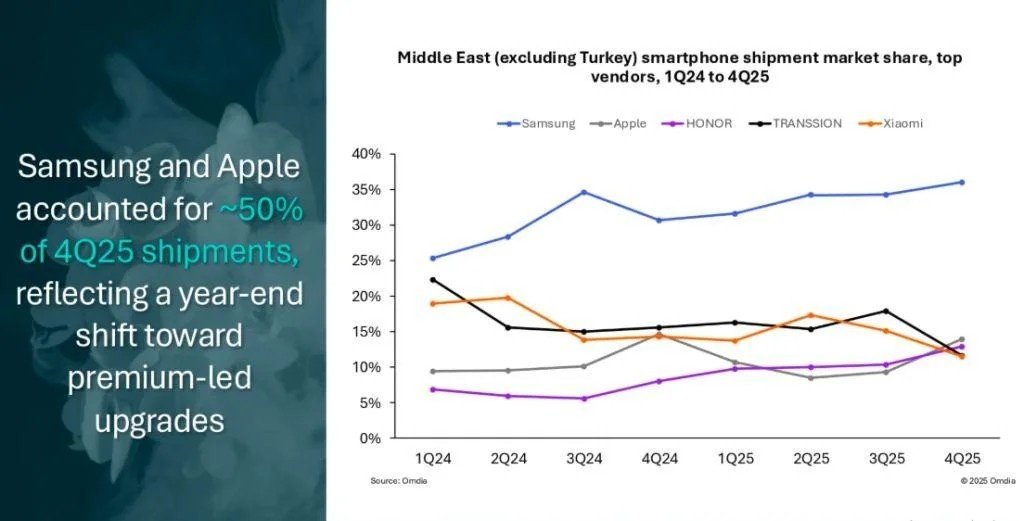

Samsung and Apple together accounted for approximately half of all shipments in the fourth quarter of 2025, highlighting the strength of established premium ecosystems and customer loyalty.

Samsung’s performance was driven by a dual strategy that combined flagship innovation with a broad portfolio of mid-range and entry-level devices. While premium models stimulated upgrade demand, its wider product range ensured strong reach across price-sensitive segments. Analysts noted that regional upgrade demand is increasingly concentrated among brands offering robust product portfolios, financing options, and strong retail distribution.

Gulf markets played a central role in sustaining regional growth. Saudi Arabia remained the largest market, expanding 14 percent year-on-year and representing around 27 percent of total shipments. The United Arab Emirates grew 12 percent, supported by refresh cycles and promotional activity. Kuwait recorded 8 percent growth, while Qatar rose 6 percent, reflecting steady replacement demand. Iraq also maintained significant shipment volumes despite market volatility.

These markets benefit from mature financing ecosystems, high tourism inflows, and strong consumer appetite for premium devices, aligning closely with Samsung’s growth strategy.

Competition intensified during the year. HONOR emerged as the fastest-growing major vendor, with shipments surging 94 percent year-on-year. TRANSSION experienced shipment declines but continued repositioning toward value-focused offerings through TECNO. Xiaomi recorded a modest decline, reflecting its heavier reliance on entry-level volumes.

Rising component costs and selective supply constraints are expected to create additional pressure on volume-driven Chinese manufacturers, potentially reinforcing Samsung’s relative stability in the region.

Looking ahead, smartphone shipments in the Middle East are projected to decline by 8 percent in 2026 amid tighter supply conditions and affordability pressures. However, leading vendors are expected to prioritize scale markets such as Saudi Arabia and the UAE, where premium demand remains resilient.

Over the longer term, the market is forecast to transition toward steady replacement-driven growth, reducing volatility. For Samsung, this shift aligns with its strategy of combining premium innovation with comprehensive portfolio coverage, supporting continued regional leadership.