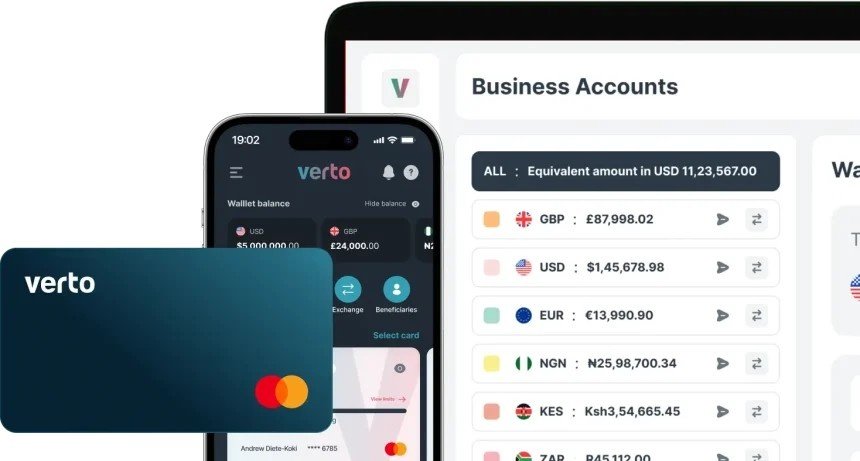

In 2023, Oman experienced a remarkable surge in mobile payments, marking a major shift in the country’s financial behavior. This growth is part of a broader movement towards digital financial solutions, driven by the Central Bank of Oman’s (CBO) efforts to modernize the country’s payment systems and align with Oman Vision 2040.

The mobile payments sector saw an extraordinary increase in transactions, with the Mobile Payments Clearing and Settlement System (MPCSS) rising from 4.9 million transactions in 2022 to 40 million by the end of 2023—a 700% increase. This surge reflects the growing demand for faster, more secure payment methods. The total value of transactions processed through MPCSS reached OMR 1.44 billion, demonstrating the increasing preference for mobile payments across the nation.

The CBO’s efforts also included advancements in other key systems such as the Real-Time Gross Settlement (RTGS), which handles high-value interbank payments. While the number of RTGS transactions decreased, the value increased by 17%, reaching OMR 209 billion in 2023. This highlights the steady demand for secure, real-time settlement of large transactions.

Retail payment systems also saw robust growth, with total transactions increasing by 41% to reach 395 million, and the total value rising by 16% to OMR 31.9 billion. Additionally, card-based transactions on the OmanNet network grew by 30%, reaching OMR 6.4 billion. The growth is attributed to the widespread adoption of Point-of-Sale (POS) systems, which are now integral to the country’s retail sector.

The Automated Clearing House (ACH) system, which handles recurring payments like salaries, also experienced significant growth in 2023, with both transaction volume and value increasing by 18%. By year-end, ACH processed 21.9 million transactions worth OMR 13.5 billion, underscoring the shift towards digital systems for automated financial operations.

Meanwhile, traditional payment methods, such as cheques, continued to decline. The number of cheques processed through the Electronic Cheque Clearing (ECC) system dropped by 1%, although the total value increased to OMR 10 billion.

The Wages Protection System (WPS) introduced by the Ministry of Labour has also contributed to the shift towards digital payments, with salary-related transactions increasing by 3% in volume and 4% in value in 2023.

Despite these gains, transactions via ATMs declined by 11% in 2023, reflecting the shift away from cash-based systems. E-commerce transactions also saw a slight decline, from 17% in 2022 to 15% in 2023, as consumers increasingly prefer alternative digital payment methods.

Overall, these developments signal Oman’s growing adoption of digital payments, with mobile payments leading the way. The Central Bank of Oman’s modernization efforts are playing a critical role in transforming the country’s financial landscape and supporting its economic future.