Pakistan assembled a total of 12.05 million mobile phone handsets in the first five months of 2025, significantly outpacing commercial imports, which amounted to just 0.76 million units during the same period, according to the latest data from the Pakistan Telecommunication Authority (PTA). This marks a remarkable milestone as local manufacturing and assembly fulfilled approximately 94% of the country’s mobile phone demand, far surpassing the five-year average (2020–2024) of 77% and the nine-year average (2016–2024) of 52%.

Breaking down the assembly figures, of the 12.05 million units, 6.53 million were 2G phones, with the remaining 5.52 million being smartphones. This trend reflects Pakistan’s growing domestic manufacturing capacity and a strategic push towards self-reliance in mobile handset production. For context, in the entire year of 2024, Pakistan assembled 31.38 million handsets locally, while only 1.71 million units were imported commercially.

Leading Mobile Brands in Local Assembly

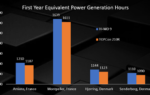

The PTA’s data highlights the dominance of several key brands in local assembly during the first five months of 2025. Infinix led the pack with 1.34 million units, closely followed by VGO Tel with 1.33 million units, and Itel at 1.07 million units. Other prominent players included Vivo (0.96 million), Samsung (0.67 million), Xiaomi (0.65 million), G’Five (0.64 million), Tecno (0.62 million), Nokia (0.52 million), and Q Mobile (0.5 million).

The robust domestic assembly sector has contributed to a dynamic market where, according to PTA figures, 67% of mobile devices active on Pakistani networks are smartphones, while 33% are legacy 2G devices.

Consumer Complaints and Resolution Performance

Alongside manufacturing data, the PTA reported receiving over 10,000 consumer complaints related to telecom and internet services in May 2025, showcasing its active role in consumer protection and service quality monitoring. The authority successfully resolved an impressive 97.92% of these complaints, underscoring effective regulatory responsiveness.

Breaking down complaints by operator, Jazz received the highest volume at 3,543 complaints, followed by Zong with 2,724, Telenor with 1,722, and Ufone with 1,129. Resolution rates varied across operators, with Jazz achieving a 99.3% resolution rate and Ufone 97.4%. Additionally, 126 complaints were logged against basic telephony services, with an 89.7% resolution rate. Complaints against internet service providers numbered 695, with 90.5% resolved satisfactorily.