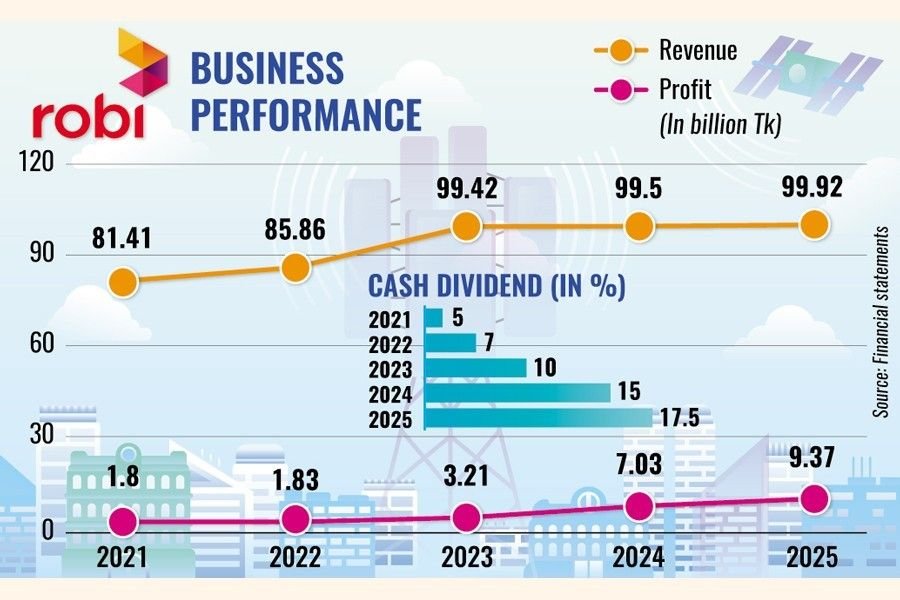

Robi Axiata posted a record net profit of Tk 9.37 billion in 2025, marking a year-on-year increase of more than 33 per cent, supported by lower operating expenses and a reduced impact of currency devaluation despite a challenging macroeconomic environment.

The second-largest telecom operator in Bangladesh recorded marginal revenue growth of 1 per cent, with total revenue reaching Tk 99.92 billion. The modest top-line expansion was largely due to continued decline in voice revenue, as sustained high inflation and adverse economic conditions constrained subscriber spending.

Robi’s Managing Director and CEO, Ziad Shatara, said that strong data revenue growth helped offset the slide in voice earnings. The increase was driven by significant additions of data and 4G users, alongside higher data consumption per subscriber.

The company’s active subscriber base reached 57.4 million at the end of 2025, with 0.70 million net additions during the year. Of the total subscriber base, 44.5 million — or 77.5 per cent — are data users, while 69.5 per cent are 4G users, the highest proportions among operators in Bangladesh.

Robi continued investing in spectrum and network expansion, deploying new spectrum and rolling out additional sites across the country. Capital expenditure for 2025 stood at Tk 13.04 billion, aimed at strengthening coverage and improving service quality.

By year-end, Robi’s total 4G sites reached 19,000, providing coverage to 99 per cent of the population, according to the company. Additional 4G sites were deployed across 40 districts to enhance connectivity in underserved areas.

Following its attainment of 4G leadership, Robi became the first telecom operator in Bangladesh to launch 5G services in September last year and is currently working to expand the 5G ecosystem.

Buoyed by strong profitability, the company declared a 17.5 per cent cash dividend for 2025 — its highest since listing in 2020. The dividend payout represents 98 per cent of annual profit.

Robi also contributed Tk 62.01 billion to the national exchequer during the year, equivalent to 62 per cent of its annual revenue, through various taxes and regulatory payments. However, management noted that a heavy tax regime remains a constraint on industry progress.

Despite record earnings, Robi’s share price declined 2.22 per cent to Tk 30.8 on the Dhaka Stock Exchange following the announcement. Net operating cash flow per share improved to Tk 9.04, compared with Tk 8.83 in 2024.

Robi Axiata, listed since December 2020, is majority-owned by Malaysia’s Axiata Group Berhad with a 61.82 per cent stake, while Bharti Airtel holds 28.18 per cent and public shareholders own the remaining 10 per cent.