Bahrain Strengthens Position as Regional Launchpad for Global Fintech Expansion

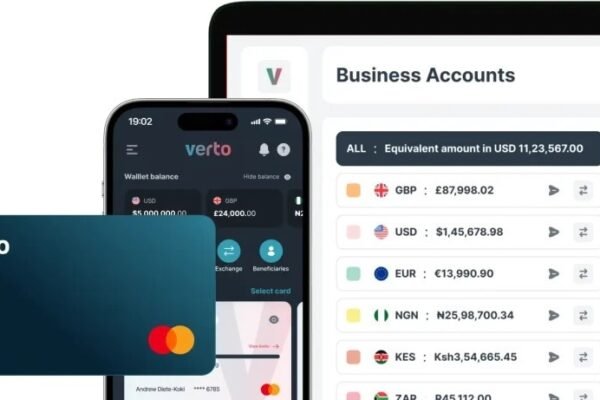

Bahrain’s Fintech Forward 2025 brings Binance founder Changpeng Zhao and Shazam co-founder Dhiraj Mukherjee to the stage, underscoring Bahrain’s emergence as a fintech hub. With strong regulatory frameworks and digital innovation, the Kingdom cements its role as the launchpad for global firms entering the Middle East.