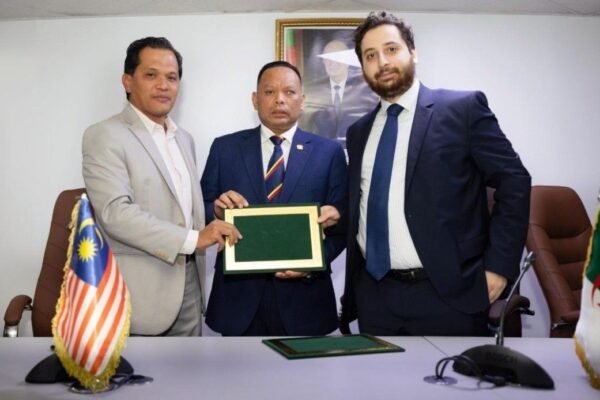

Malaysian BerryPay and Algerian DIGITEC Partner to Launch Digital Payment Platform in Algeria

BerryPay and DIGITEC join forces to launch an Algerian digital payment platform, enhancing financial inclusion and cross-border remittances, while supporting Algeria’s digital banking growth amid evolving regulatory frameworks.