Egypt’s mobile wallet sector recorded significant growth in the second quarter of 2025, with financial transactions soaring 80% year-on-year to 718 million, according to the National Telecommunications Regulatory Authority (NTRA). The total value of these transactions jumped 72% to EGP 943 billion, up from EGP 548.6 billion in the same period last year.

Active wallets grew 29% to reach 46.3 million, reflecting the sector’s rising adoption. Vodafone Cash continued to dominate the market, accounting for 55% of wallets, 78% of transactions, and 81% of transaction value. It was followed by e& Cash (21%), Orange Cash (19%), and WE Pay (5%).

Peer-to-peer transfers made up the largest portion of activity, representing 54% of transactions by volume and 71% by value. This was followed by mobile and internet top-ups (20% of volume), deposits (19% of volume, 15% of value), and withdrawals (5% of volume, 11% of value). Other payments, such as bills, donations, and retail purchases, represented only 2%.

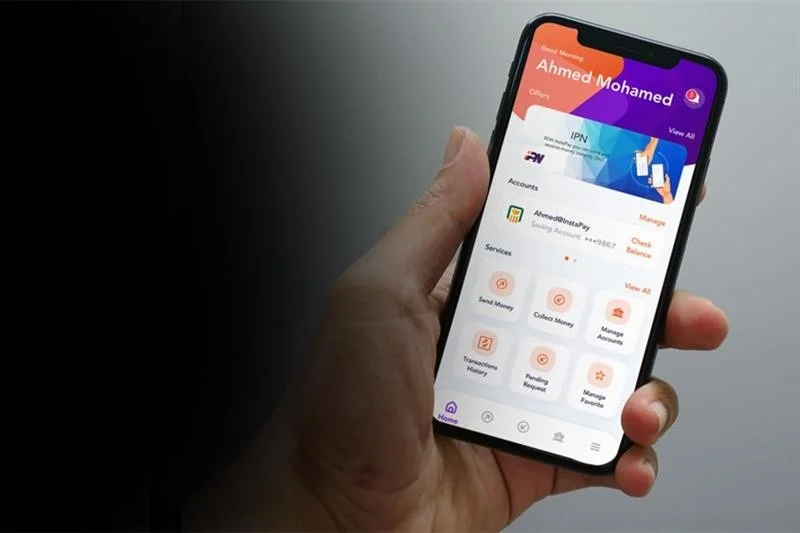

Deposits were mainly driven by bank-to-wallet transfers via InstaPay (65%), while cash deposits accounted for 22%. International remittances contributed 7%, card-to-wallet 3%, and ATM deposits another 3%. Withdrawals were dominated by direct cash withdrawals (79%), with other payments at 15% and mobile top-ups at 6%.

To strengthen the sector, NTRA introduced new regulations to reduce fraud and enhance user protection. It also approved a service enabling Egyptians abroad to send remittances directly into local mobile wallets in Egyptian pounds, expanding access to secure and official transfer channels.