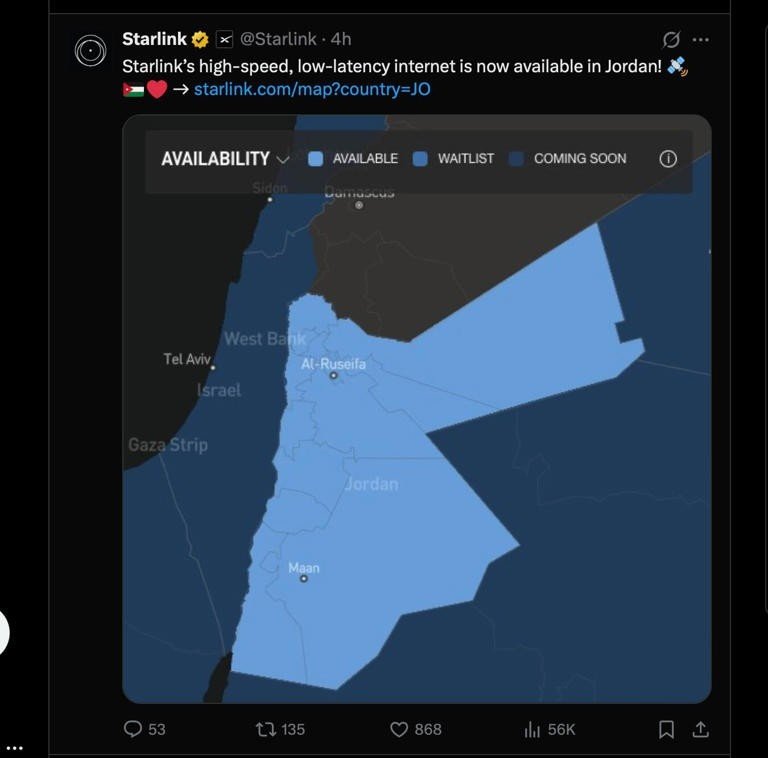

Starlink, the satellite internet company operated by Elon Musk’s SpaceX, has officially launched its services in Jordan, marking another milestone in its regional expansion across the Middle East. The announcement was made via the company’s official social media channels, confirming that users in Jordan can now access Starlink’s high-speed, low-latency satellite internet.

With this rollout, Jordan joins Oman, Qatar, and Yemen as the latest countries in the region to gain access to Starlink’s network. The move was widely welcomed by Middle Eastern technology vendors and industry leaders. Jimmy Grewal, Managing Director of UAE-based marine technology integrator Elcome, congratulated SpaceX’s licensing team on LinkedIn, writing, “Congratulations to the licensing team and SpaceX for making progress here. Which country will be next?”

The expansion into Jordan follows Oman’s approval of Starlink’s operations earlier this year, as regional regulators continue to open doors to next-generation satellite broadband services. According to Starlink’s service map, both Kuwait and Bahrain are expected to gain access later in 2025, while availability in Saudi Arabia and the UAE remains “pending regulatory approval.”

A document published by the UAE’s Telecommunications and Digital Government Regulatory Authority (TDRA) confirmed that Starlink was granted a 10-year licence in 2024 for “maritime satellite internet services”, a move expected to enhance connectivity for offshore and coastal operations.

Globally, Starlink has connected over three million users in more than 100 countries, using a constellation of over 7,000 low-Earth orbit (LEO) satellites. Its standard antennas weigh less than 3kg, contain no moving parts, and are designed to operate in harsh conditions.

Unlike traditional satellites orbiting at 20,000–35,000km, Starlink’s satellites orbit at around 550km, reducing latency and significantly improving speed — particularly valuable in remote or infrastructure-deficient areas. These LEO networks have proven especially effective in conflict zones and disaster-hit regions where ground-based connectivity is unavailable.

The satellite broadband market is projected to grow rapidly, with Morgan Stanley estimating it could reach $400 billion by 2040, roughly 40% of the global space economy’s projected $1 trillion valuation. While Starlink remains the dominant player, competition is mounting — Amazon’s Project Kuiper recently announced the launch of its first 27 satellites, signaling a new era of satellite internet rivalry.

Starlink’s arrival in Jordan underscores the Middle East’s accelerating adoption of space-based communications, bringing high-speed connectivity to underserved areas and reinforcing the region’s ambitions to lead in next-generation digital infrastructure.