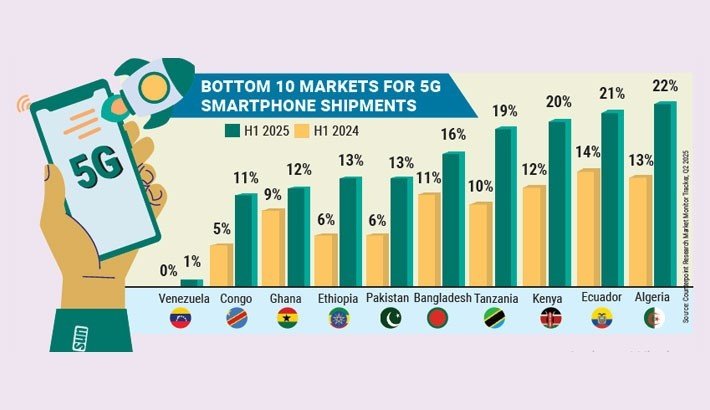

DHAKA – Bangladesh ranks among the world’s bottom 10 countries in 5G smartphone adoption, with 5G-enabled devices accounting for just 16% of total smartphone shipments in the first half of 2025, compared to a global average of 71%, according to a new report from Counterpoint Research.

Despite being one of Asia’s largest and fastest-growing smartphone markets, Bangladesh’s slow adoption stems from high handset prices, limited 5G network coverage, and low consumer demand for faster connectivity. Most 5G devices remain priced above US$250, while the majority of phones sold in the country are under US$150, restricting access for cost-sensitive consumers.

Early Signs of Change

The country’s telecom landscape is now beginning to shift. Robi Axiata and Grameenphone (GP) recently launched commercial 5G services in Dhaka and other major cities — a milestone in Bangladesh’s digital transformation journey. Analysts believe this rollout will gradually accelerate 5G smartphone penetration in the coming quarters.

Smartphone brands have been quick to respond. TECNO introduced its POVA 5G Series, offering three models designed to make 5G more accessible, while VIVO is launching its Vivo V60 Lite 5G at the International Convention City Bashundhara.

“As Bangladesh steps into the 5G era, TECNO is committed to bringing devices that combine innovation with accessibility,” said Rezwanul Hoque, CEO of Ismartu Technology BD Limited.

Adoption Barriers and Market Dynamics

Experts highlight that Bangladesh’s smartphone market remains price-sensitive, and low average revenue per user (ARPU) has slowed operator investment in widespread 5G infrastructure. According to tech analyst MN Nahid, “Bangladesh is witnessing a steady rise in 5G-ready smartphones, yet the absence of a wider rollout continues to hold us back. Thousands are ready, but the network isn’t.”

Consumer priorities such as battery life, camera quality, and storage capacity continue to outweigh interest in ultra-fast connectivity. Analysts predict 4G will remain the dominant network until at least 2030, unless affordable devices and broader coverage drive a market shift.

Regional and Global Context

Bangladesh joins Pakistan in the global bottom 10, as Pakistan has yet to launch 5G services amid repeated spectrum auction delays. In contrast, India’s rapid rollout, backed by strong policy support and competitive pricing, has pushed its 5G smartphone share above 80%.

Globally, Venezuela recorded the lowest 5G penetration at 1%, while several African countries — including Ethiopia, Kenya, and Ghana — also ranked among the lowest due to infrastructure challenges and high device costs.

Telcos and Industry Outlook

Bangladeshi operators are pursuing phased deployment strategies. Robi is focusing on areas with higher concentrations of 5G-ready devices, while Grameenphone is targeting industrial and enterprise use cases, such as automation and real-time data processing.

“Adoption will take time, but as more affordable handsets enter the market and new use cases emerge, readiness will improve,” said Shahed Alam, Robi’s Chief Corporate and Regulatory Affairs Officer.

GP’s Tanveer Mohammad echoed this optimism: “In the short term, our focus is on sectors that require strong connectivity, real-time data, and automation.”

Experts suggest that collaborations between operators and smartphone brands, through bundled offers and EMI financing, could help accelerate adoption. Chinese manufacturers, long credited with driving digital inclusion in Bangladesh, are expected to play a central role in bringing affordable 5G to mass consumers.

“As infrastructure expands and pricing becomes more accessible, Bangladesh could see exponential 5G growth by 2027,” said Nahid. “It’s not just about faster internet — it’s about enabling a smarter, more connected economy.”