Dhaka, November 4, 2025 — In a landmark decision aimed at accelerating smartphone adoption and digital inclusion, the Bangladesh Telecommunication Regulatory Commission (BTRC) has approved a new policy framework allowing mobile operators to sell smartphones on installments using SIM-lock technology.

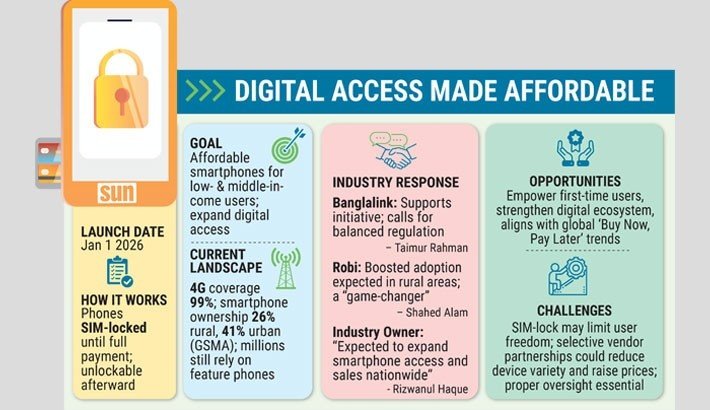

Starting January 1, 2026, major operators — Grameenphone, Robi, Banglalink, and Teletalk — will be permitted to sell BTRC-approved smartphones with network locks that remain active until installment payments are fully completed. Once paid off, users can unlock their devices for use with any operator.

The initiative is expected to bridge the digital divide, especially in rural and low-income communities, where smartphone ownership remains limited despite 99% 4G coverage. According to the GSMA, smartphone penetration currently stands at only 26% in rural areas and 41% in urban regions, leaving millions dependent on feature phones.

The new framework mandates customer consent, transparent pricing, and strict consumer protection measures to ensure fair practices. It replaces a June 2025 directive that had allowed only partial SIM-slot locking.

Industry leaders have largely welcomed the move. Taimur Rahman, Chief Corporate and Regulatory Affairs Officer at Banglalink, said: “We welcome initiatives that help increase mobile phone penetration and bridge the digital divide. However, a balanced regulatory approach is crucial to sustain both industry and consumer interests.”

Shahed Alam, Chief Corporate and Regulatory Officer at Robi Axiata PLC, called it a “game-changer” for the telecom sector, adding that installment-based models will expand access in rural and underserved areas.

The framework mirrors global “Buy Now, Pay Later” trends that have transformed mobile accessibility. Rizwanul Haque, Vice President of the Mobile Phone Industry Owners’ Association of Bangladesh, noted that the policy “will boost smartphone sales and accelerate nationwide digital transformation,” particularly with the National Equipment Identity Register (NEIR) system ensuring compliance.

Financing platforms such as PalmPay, TopPay, MomoPay, and SohojPay already facilitate installment purchases for brands like TECNO, Infinix, itel, Realme, OPPO, OnePlus, VIVO, and Walton — collectively representing over 20% of total smartphone sales. With 18 domestic factories operated by brands including Xiaomi, Samsung, OPPO, Vivo, and Realme, local production is expected to see record growth.

Analysts hailed the policy as a turning point for digital transformation in Bangladesh but urged vigilance against potential pitfalls such as limited device choice, pricing opacity, or lock-in misuse. “The move can uplift millions if it empowers users rather than restricts them,” said MN Nahid, a Dhaka-based telecom analyst.

The BTRC has outlined additional safeguards requiring telcos to work only with approved importers or manufacturers, comply with banking and financial regulations, ensure data protection, and report sales and installment activity regularly.