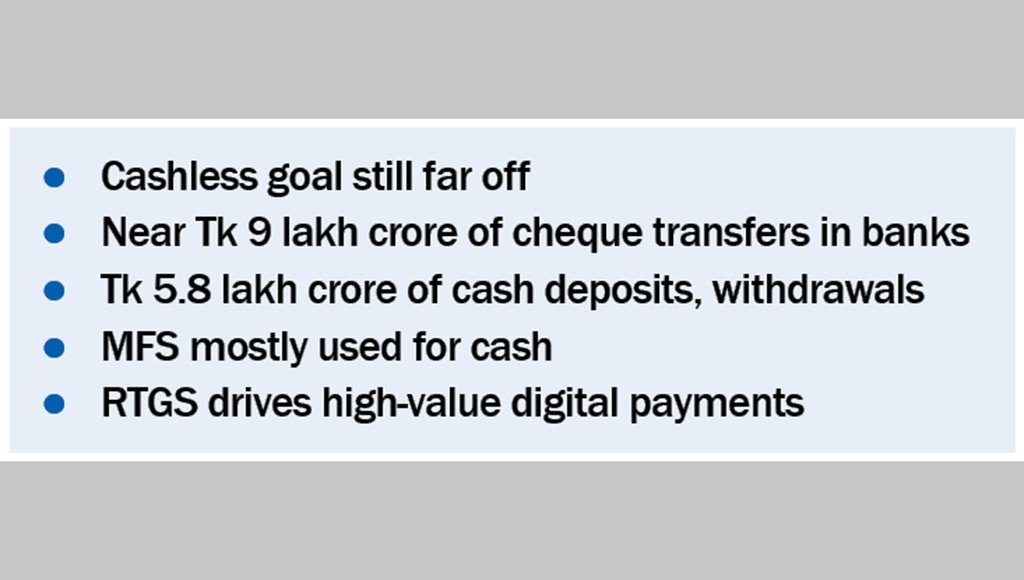

Cash transactions continued to dominate Bangladesh’s financial system in October 2025, accounting for 65.41 percent of total transaction value, despite sustained policy efforts to promote a cashless and digitally driven economy. Data released by Bangladesh Bank show that non-digital channels remain deeply entrenched, raising concerns about the pace and effectiveness of financial digitalisation.

Total transactions during the month amounted to Tk 26.67 lakh crore, of which Tk 17.44 lakh crore flowed through non-digital channels such as cash-based mobile financial services (MFS), over-the-counter banking, cheque transactions, and ATM withdrawals. Digital transactions accounted for Tk 9.23 lakh crore, or 34.59 percent of total value, indicating that nearly two-thirds of financial activity still relies on manual or cash-based methods.

The dominance of non-digital transactions contrasts with government and central bank narratives positioning digital payments as tools to reduce cash dependency, improve transparency, and lower transaction costs. While policymakers have highlighted digital finance as a way to curb illicit flows and expand financial inclusion, the data suggest persistent structural resistance and trust-related challenges.

Banking sector activity largely explains the imbalance. Non-digital banking transactions made up 62.23 percent of total transaction value in October, driven by cheque and voucher-based transfers worth Tk 8.91 lakh crore and cash deposits and withdrawals totaling Tk 5.78 lakh crore. In comparison, all digital banking transactions combined represented just 30.49 percent of total value, despite growth in RTGS and interbank digital transfers.

Mobile financial services, often described as the backbone of Bangladesh’s digital finance push, showed mixed results. Although MFS accounted for more than 83 percent of total transaction volume, much of this activity involved cash-in and cash-out transactions. In October, cash-based MFS transactions stood at Tk 84,754 crore, compared with Tk 1.09 lakh crore in digital MFS payments. Overall, MFS contributed only 7.28 percent of total transaction value, underscoring their continued role in small-value transfers rather than mainstream commercial payments.

Digital transactions have increased only marginally in recent months. In June, non-digital channels accounted for 68.25 percent of total value, compared with 65.41 percent in October. While the digital share rose to 34.59 percent, the slow pace of change suggests progress remains below policy expectations.

Experts cite multiple barriers to wider adoption, including business preference for cheques in high-value transactions, limited POS and QR payment acceptance, concerns over cyber risks and service disruptions, transaction costs, and low digital literacy in rural areas. The data also show that high-value payments continue to bypass retail digital channels, with RTGS alone accounting for nearly 22 percent of total transaction value, highlighting that digitalisation remains concentrated at the institutional level rather than everyday economic activity.