Rabat, November 5, 2025 — Morocco’s mobile sector is witnessing renewed momentum, with Orange Morocco gaining market share while competitors Maroc Telecom and Inwi lose ground, according to new data from the National Telecommunications Regulatory Agency (ANRT) for Q2 2025.

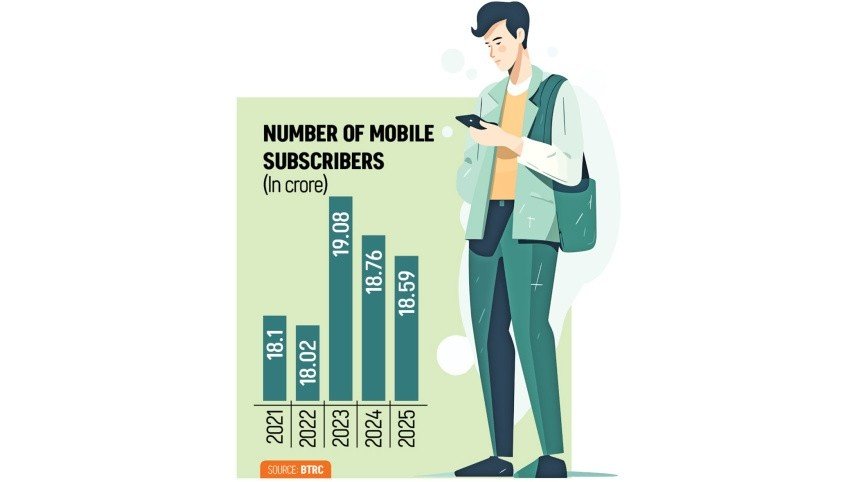

The total number of mobile subscriptions rose 3.2% year-on-year to reach 58.75 million by the end of June, marking a recovery following earlier declines. Operators collectively added 1.36 million lines between March and June, reflecting a rebound in consumer activity and data-driven service adoption.

Orange Gains Ground

Orange Morocco, majority-owned by Orange S.A. (EPA:ORA), increased its market share to 34.7%, consolidating its position as Morocco’s leading operator. Inwi (Wana Corporate) — backed by Al Mada/SNI and Zain Group (Boursa Kuwait:ZAIN) — slipped to 33.2%, while Maroc Telecom (CSE:IAM) fell to 32.1%. The figures are based on active SIMs as defined under ANRT’s methodology.

Data and Fibre Growth Fuel Sector Momentum

Prepaid services continued to dominate, accounting for 86% of connections. However, postpaid subscriptions are expanding steadily, driven by rising data consumption and customer retention efforts through bundled services.

The fibre-to-the-home (FTTH) segment saw the most rapid growth, reaching 1.2 million subscriptions — a 26% year-on-year increase. Uptake was strongest in Casablanca, Rabat, and Agadir, with secondary cities now seeing accelerated adoption.

Broadband Penetration and Competitive Shifts

Mobile broadband penetration has exceeded 110%, reflecting widespread multi-SIM ownership and growing demand for faster data speeds. Operators are investing heavily in fibre expansion, 4G densification, and converged mobile–home offerings. Competitive pricing, particularly for entry-level FTTH plans, remains central to capturing new customers.

As competition intensifies, Morocco’s telecom landscape is transitioning from subscriber acquisition to value-driven growth, underpinned by network performance, service bundling, and digital convergence.