The top benefits of sending and receiving international payments digitally are ease of use, privacy, security, and enhancing the lives of friends and family. According to Visa’s annual “Money Travels: 2024 Digital Remittances Adoption” report, 56% of surveyed remittance users in the UAE anticipate using digital money transfers more frequently in the future.

As remittances remain a vital source of support for millions of expatriates in the UAE and their families, the research found that UAE remittance senders are primarily motivated by the need to provide regular assistance to families abroad and to address unexpected emergencies. Additionally, the report revealed that senders are increasingly prioritizing aid for those in need in response to global events.

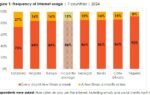

The “Money Travels: 2024 Digital Remittances Adoption” study examines how consumers send money abroad, exploring rates, methods, and reasons for transactions. The global survey included nearly 45,000 respondents, highlighting the crucial need for fast, easy, and secure payment methods for families, communities, and economies in the UAE and worldwide. The report also found that over two-thirds of remittance users in various markets prefer digital applications for moving money globally.

While global remittances have declined year-over-year due to various economic challenges, survey results in the UAE—identified as a country with a higher percentage of remittance senders compared to receivers—show a positive outlook. Notably, 73% of respondents in the UAE plan to send the same amount or more money abroad in the future.

“Security, ease, and speed are the top priorities for expatriates in the UAE when sending money abroad to support their families or aid individuals in crisis,” said Visa’s Salima Gutieva, VP and Country Manager for UAE. “This research demonstrates that digital payments are becoming essential for providing instant support, whether for unexpected medical bills, education, or food. However, more work is needed within the industry to streamline cross-border money movements and create new opportunities for financial inclusion and wealth building in communities that rely on these vital payments.”

Key highlights from the study include:

- Digital payments are the fastest method for sending and receiving money. Ease of use, privacy, security, and convenience for friends and family are cited as the top benefits of digital international payments.

- Digital apps remain the preferred method for sending and receiving remittances in the UAE, followed by digital remittances at physical locations. Usage of physical remittances has declined among senders in the UAE, with 9-15% of senders not using cash, checks, or money orders as of December 2022.

- Physical payments can carry hidden fees, as 50% of UAE respondents reported being offered free transfers when sending cash, checks, or money orders, only to discover hidden fees later.

- High fees, including those related to exchange rate calculations, are a significant concern for digital transfers. Fees were a key issue for 38% of remittance senders and 33% of recipients, while 20% of senders and 23% of recipients struggled with calculating exchange rates.

- Education costs and supporting individuals in crisis are among the primary motivations for UAE remittance users to send money.

Visa collaborates with global remitters and enablement partners, such as Brightwell, Thunes, Remitly, Western Union, and Asia United Bank (AUB), to facilitate efficient money movement through digitized remittances. In the UAE, Visa is working with its financial institution partners to enable the Visa Alias Directory, addressing the growing demand for easier, cost-effective, and secure international money transfers. This system allows consumers to send and receive money internationally using just their phone numbers, eliminating the need for long and complex account details.