Zero Processing Fee; GTBank Removes Point of Sale (POS) Processing Fees to Support Businesses

The Zero Processing Charge campaign aligns with GTBank’s ongoing efforts to empower businesses with innovative financial solutions that drive growth…

The Zero Processing Charge campaign aligns with GTBank’s ongoing efforts to empower businesses with innovative financial solutions that drive growth…

At the UN’s Summit of the Future Action Days, Egypt’s Minister Amr Talaat highlighted Egypt’s digital transformation, focusing on accessible government services and improving rural internet connectivity. The “Decent Life” initiative will impact over 58 million Egyptians, promoting digital skills and fostering inclusive growth.

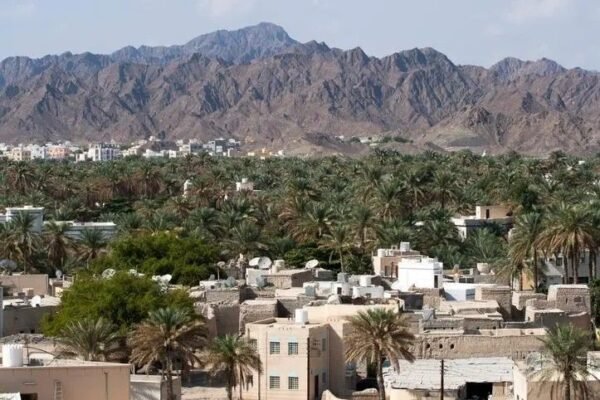

Omantel reported RO 3.03 billion in revenue for 2024, driven by strong domestic growth and regional performance through Zain Group. Its new “Portal to the Future” strategy focuses on AI, cloud, fintech, and sustainability, positioning the company as a key enabler of Oman Vision 2040 and regional digital transformation.

du has achieved a remarkable global ranking in the Microsoft Viva Glint Culture & Employee Engagement survey, securing a score of 85 and ranking in the top 25% of technology sector performers. This achievement highlights du’s commitment to creating a vibrant and inclusive workplace culture that drives organizational success.

Ooredoo Algeria has launched a blood donation campaign to support the country’s health system, demonstrating its commitment to social responsibility. The initiative received strong employee participation, underscoring Ooredoo’s role as a responsible corporate entity that actively supports community welfare and addresses vital health needs.

Fonepay has partnered with Alipay+ to enable cross-border QR payments in Nepal. The deal allows travelers from 11 countries to pay local merchants via their home e-wallets, boosting SMEs, tourism, and financial inclusion while strengthening Nepal’s digital economy and global payment interoperability.

stc Bahrain successfully participated as a Gold Sponsor at CyberX Bahrain 2025, showcasing its advanced cybersecurity solutions. The event emphasized the company’s role in enhancing Bahrain’s cybersecurity landscape and supporting the Kingdom’s Vision 2030 goals. stc Bahrain highlighted its partnerships with global cybersecurity innovators to address evolving digital threats.

Sadad has partnered with Mastercard to introduce a digital payment gateway in Qatar, powered by Mastercard Gateway. This collaboration enables merchants to offer secure and seamless transactions, enhancing customer experiences and reducing fraud. The platform supports over 30 payment methods, empowering local businesses with advanced payment solutions.

Egypt’s mobile manufacturing sector is expanding, boasting a production capacity of 11.5 million units and $87.5 million in investments. This growth has created 2,050 jobs and is part of an effort to increase the ICT sector’s GDP contribution, with significant new factories from Samsung, Vivo, and others driving this surge.

Mastercard and Dinarak collaborate to boost digital payments in Jordan through prepaid card solutions, aiming to improve financial access for unbanked populations and address the gender gap in financial inclusion.